The Fair Labor Standards Act (FLSA) requires employers to compensate their employees for all hours employees are “suffered or permitted” to work. This requirement includes payment of at least the federal minimum wage and overtime pay for all hours worked in excess of 40 in a workweek. However, the FLSA provides certain exemptions from minimum wage and overtime payment provisions. Among these, the most common are the “white-collar” exemptions.

The FLSA white-collar exemptions apply to individuals in executive, administrative, professional (EAP), and some outside sales and computer-related occupations. Some highly compensated employees (HCEs) may also qualify for the FLSA white- collar overtime exemption.

On April 23, 2024, the U.S. Department of Labor (DOL) announced a final rule to amend current requirements employees in white-collar occupations must satisfy to qualify for an overtime exemption under the FLSA. The final rule will take effect on July 1, 2024.

According to the DOL, updating the salary level test will more effectively identify who is employed as a bona fide EAP to help ensure that the FLSA’s intended overtime protections are fully implemented. This Compliance Bulletin provides a high-level summary of the DOL’s final rule and its potential implications for employers.

Overview of the FLSA

The FLSA is the federal labor law that provides basic workplace protections to most workers in the United States and guarantees them at least the federal minimum wage for every hour they work and overtime at not less than 1.5 times their regular rates of pay for hours they work beyond 40 in a workweek. The FLSA is enforced by the DOL’s Wage and Hour Division (WHD) and covers more than 143 million workers.

Generally, the FLSA applies to employees of enterprises with an annual gross volume of sales made or business done totaling

$500,000 or more and to employees individually covered by the law because they are engaged in interstate commerce or the production of goods for commerce. In addition, employees of certain entities are covered by the FLSA regardless of the amount of gross volume of sales or business done. These entities include hospitals, businesses providing medical or nursing care for residents, schools (whether for-profit or not-for-profit) and public agencies.

The FLSA’s White-collar Exemptions

While the FLSA applies to the majority of employees in the United States, it allows employers to claim exemptions from some of its wage and hour requirements for certain employees whose jobs meet specific criteria. Section 13(a)(1) of the FLSA provides an exemption from both minimum wage and overtime requirements for employees employed as bona fide EAP or outside sales employees. Section 13(a)(1) and Section 13(a)(17) also exempt certain employees in computer-related occupations. These exemptions are defined in the DOL’s regulations.

To qualify for a white-collar exemption, an employee must satisfy every applicable test for that exemption. The three tests for the white-collar exemptions are:

- The salary basis test—The employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed;

- The salary level test—The amount of the salary paid must meet a specified minimum amount; and

- The duties test—The employee’s job duties must primarily involve those associated with EAP, outside sales or computer

It is important to note that simply paying an employee a salary does not relieve an employer of minimum wage and overtime obligations to that employee. Unless they meet all the criteria for a specific exemption, employees covered by FLSA protections who are paid a salary are still due overtime pay if they work more than 40 hours in a week.

Key Provisions of the Final Rule

Increases to the Earnings Thresholds

The DOL’s final rule amends current requirements employees in white-collar occupations must satisfy to qualify for an FLSA overtime exemption. To qualify for this exemption under the final rule, white-collar employees must satisfy the new standard salary level tests.

Updates to the Standard Salary Level

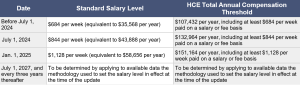

Under the final rule, the standard salary level will change as follows:

- On July 1, 2024, the DOL will update the standard salary level using the existing methodology from the 2019 final rule (i.e., setting the standard salary level at the 20th percentile of weekly earnings of full-time salaried workers in the lowest- wage census region) and current data, raising the salary level from $684 per week to $844 per week (equivalent to $43,888 per year);

- On Jan. 1, 2025, the DOL will implement the new salary methodology, setting the standard salary level at the 35th percentile of weekly earnings of full-time salaried workers in the lowest-wage Census Region, resulting in a salary level of $1,128 per week (equivalent to $58,656 per year); and

- On July 1, 2027, and every three years thereafter, the standard salary level will be updated by applying up-to-date earnings data to the salary methodology in the regulations at the time of the update, using the most recent four quarters of earnings data. The DOL will publish a notice announcing the updated salary level amount at least 150 days before the update takes effect.

Exempt computer employees may be paid a salary of at least the standard salary level per week or on an hourly basis of at least $27.63 an hour.

Updates to the HCE Total Annual Compensation Threshold

Under the final rule, the HCEs’ total annual compensation requirement will change as follows:

- On July 1, 2024, the DOL will update the HCE total annual compensation threshold using the existing methodology from the 2019 final rule (i.e., setting the HCE total annual compensation threshold at the annualized weekly earnings of the 80th percentile of full-time salaried workers nationally) and current data, raising the compensation level from $107,432 to $132,964;

- On Jan. 1, 2025, the DOL will implement the new salary methodology, setting the HCE total annual compensation threshold at the annualized weekly earnings of the 85th percentile of full-time salaried workers nationally, resulting in a compensation level of $151,164; and

- On July 1, 2027, and every three years thereafter, the HCE total annual compensation threshold will be updated by applying up-to-date earnings data to the methodology in the regulations at the time of the update, using the most recent four quarters of data. The DOL will publish a notice announcing the updated HCE threshold at least 150 days before the update takes effect.

Nondiscretionary bonuses and incentive payments (including commissions) may be counted toward the total annual compensation threshold requirement, but the employer must pay at least the full standard salary level per week (not including such bonuses or incentive payments) on a salary or fee basis to meet the HCE test. If an employee’s total compensation in a given annual period fails to meet the HCE total annual compensation threshold, an employer may make a “catch-up” payment within one month of the end of the annual period. Any catch-up payment counts only toward the prior year’s total annual compensation. If such a catch-up payment is not made within the timeframe allotted, the exemption is lost, and overtime premium pay must be paid for any week the employee worked more than 40 hours.

Future Updates to the Standard Salary Level and Total Annual Compensation Threshold

The final rule introduces a mechanism to regularly update the standard salary level and HCE total annual compensation thresholds, including an initial update to reflect earnings growth, which on July 1, 2024, will result in a standard salary level of

$844 per week ($43,888 annually) and a HCE total annual compensation level of $132,964. This update will be followed by triennial updates in the future that will apply updated earnings data to the methodologies in effect at the time of the updates. According to the DOL, regularly updating the earning thresholds helps to ensure they remain useful in differentiating between exempt and nonexempt white-collar employees. Salary levels that are not kept up to date become obsolete as wages for nonexempt employees increase over time. Additionally, long intervals between rulemakings have resulted in eroding earnings thresholds based on outdated earnings data to identify bona fide EAPs.

The standard salary level and the HCE total annual compensation requirement will be updated every three years to reflect current earnings data using the most recent available four quarters of earnings data, as published by the U.S. Bureau of Labor Statistics, and the methodologies in effect at the time of each update. Any change to the methodologies used to set the standard salary level and HCE annual compensation threshold will be effectuated through future rulemaking.

The next three-year update will take place on July 1, 2027. At least 150 days before the date of a scheduled update to the standard salary level and the HCE total annual compensation requirement, the DOL will publish a notice with the new earnings levels in the Federal Register. However, the DOL may temporarily delay a scheduled update for 120 days where unforeseen economic or other conditions warrant.

Schedule of Changes to the Standard Salary Level and HCE Thresholds

The final rule will take effect on July 1, 2024, but some increases to the EAP earnings thresholds will become applicable on future dates. All of the scheduled increases are displayed in the chart below:

Special Salary Levels and Base Rates

In the 2023 Notice of Proposed Rulemaking, the DOL proposed changing the special salary levels that currently apply in the

U.S. territories and the special base rate for employees in the motion picture industry. However, the agency did not finalize these proposed changes, and, as a result, the final rule did not change these special salary levels and such base rate that apply in U.S. territories or the special base rate for employees in the motion picture industry. The DOL has indicated that it will address these matters in a future final rule.

Next Steps for Employers

The DOL’s changes to FLSA white-collar exemptions present employers with several challenges and considerations. Increasing the salary threshold for overtime eligibility will likely result in a significant number of employees who were previously exempt now qualifying for overtime pay. The DOL estimates that 4 million workers exempt under current regulations will become entitled to FLSA overtime protections in the first year. As a result, employers need to carefully review their employee classifications and potentially reclassify those who do not meet the new criteria from exempt to nonexempt status.

Employers have a range of options for responding to the updated thresholds established in the DOL’s final rule. For each employee who is affected by the increased earnings threshold, an employer may:

- Increase the salary of the employee to at least the new salary level to retain their exempt status;

- Pay an overtime premium of 1.5 times the employee’s regular rate of pay for any overtime hours worked;

- Reduce or eliminate overtime hours;

- Reduce the amount of pay allocated to the employee’s base salary (provided that the employee still earns at least the applicable hourly minimum wage) to offset new overtime pay; or

- Use some combination of these responses.

The circumstances of each affected employee will likely impact how employers respond to this final rule. For example, employers may be more likely to give raises to employees who regularly work overtime and earn slightly below the new standard salary level to maintain their exempt status so that the employer does not have to pay the overtime premium. For employees who rarely work overtime hours, employers may simply choose to pay the overtime premium whenever necessary. The DOL accounted for these (and other) possible employer responses in estimating the final rule’s likely costs, benefits and transfers.

Failure to comply with the final rule’s threshold increases may result in substantial penalties, including back pay, liquidated damages, civil money penalties and attorneys’ fees and costs. Therefore, employers should familiarize themselves with the final rule and ensure they comply with their obligations under the FLSA. If necessary, employers should also make any necessary updates to existing compensation and worker classification practices.

Helpful Links & Resources

The DOL’s final rule

The DOL’s FAQs about the final rule

The DOL’s small entity compliance guide

Previous SIMA Payroll News:

DOL Updates Construction Worker Wages Under the Davis-Bacon Act and Related Acts

DOL Publishes FLSA Overtime Rule With Higher Salary Levels for White Collar Employees

Preparing for the DOL’s New Overtime Rule

Disclosures: This content is not intended to be exhaustive, nor should it be viewed as legal or tax advice. Information presented is believed to be current and is provided for general information and educational purposes based upon publicly available information from sources believed to be reliable. We cannot assure the accuracy or completeness of this information. It is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid any penalties. You should always consult an attorney or tax professional regarding your specific legal or tax situation. This information may change at any time and without notice. All opinions represent the judgment of the author on the date of the post and are subject to change. Content should not be viewed as personalized advice. SIMA reserves the right to edit blog entries and delete comments that contain offensive or inappropriate language. ©2023 Zywave, Inc. All rights reserved.