On October 11th, 2022, the U.S. Department of Homeland Security (DHS) announced it is extending updated flexibilities for Form I-9 due to the continued safety precautions related to COVID-19 until July 31st, 2023.

On October 11th, 2022, the U.S. Department of Homeland Security (DHS) announced it is extending updated flexibilities for Form I-9 due to the continued safety precautions related to COVID-19 until July 31st, 2023.

Background

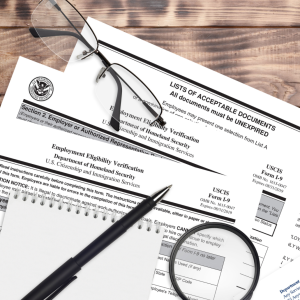

Federal law requires every employer that recruits, refers for a fee, or hires an individual for employment in the United States of America to complete an Employment Eligibility Verification form (Form I-9). To comply with Form I-9 requirements, employers must, within the first three days of employment:

- Complete and sign Section 2 for each new hire; and

- Physically examine the documents each employee presents to prove his or her employment eligibility (documents must come from the form’s list of acceptable documents).

Form I-9 Flexibilities

Since March 19th, 2020, DHS has adopted various temporary policies to provide employers flexibility in their employment eligibility compliance efforts. DHS has reviewed, renewed, and updated these Form I-9 “flexibilities” to allow employers to:

- Review identification documents remotely; and

- Accept some expired identification documents when the expiration was caused by COVID-19 disruptions.

Employers should review the original DHS guidance on remote document verification for details. Employers can access additional information about updated flexibilities on the DHS U.S. Citizenship and Immigration Services Temporary Policies Related to COVID-19 webpage.

As always, if you have any questions, please do not hesitate to contact our payroll team at payroll@simafg.com or call our office at 804-285-5700.

Disclosures This content is not intended to be exhaustive, nor should it be viewed as legal or tax advice. Information presented is believed to be current and is provided for general information and educational purposes based upon publicly available information from sources believed to be reliable. We cannot assure the accuracy or completeness of this information. It is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid any penalties. You should always consult an attorney or tax professional regarding your specific legal or tax situation. This information may change at any time and without notice. All opinions represent the judgment of the author on the date of the post and are subject to change. Content should not be viewed as personalized advice. SIMA reserves the right to edit blog entries and delete comments that contain offensive or inappropriate language. ©2022 Zywave, Inc. All rights reserved.